Different Types of Rug Pulls

Generally speaking, in a rug pull scam a team promotes their project and then disappear with the funds. The promoters might promise to donate money to charity, create live events, or create more artwork. By stealing all of the money, the team leaves collectors with valueless assets. The promoters don’t fulfill any of their obligations. They just fill their pockets and leave.

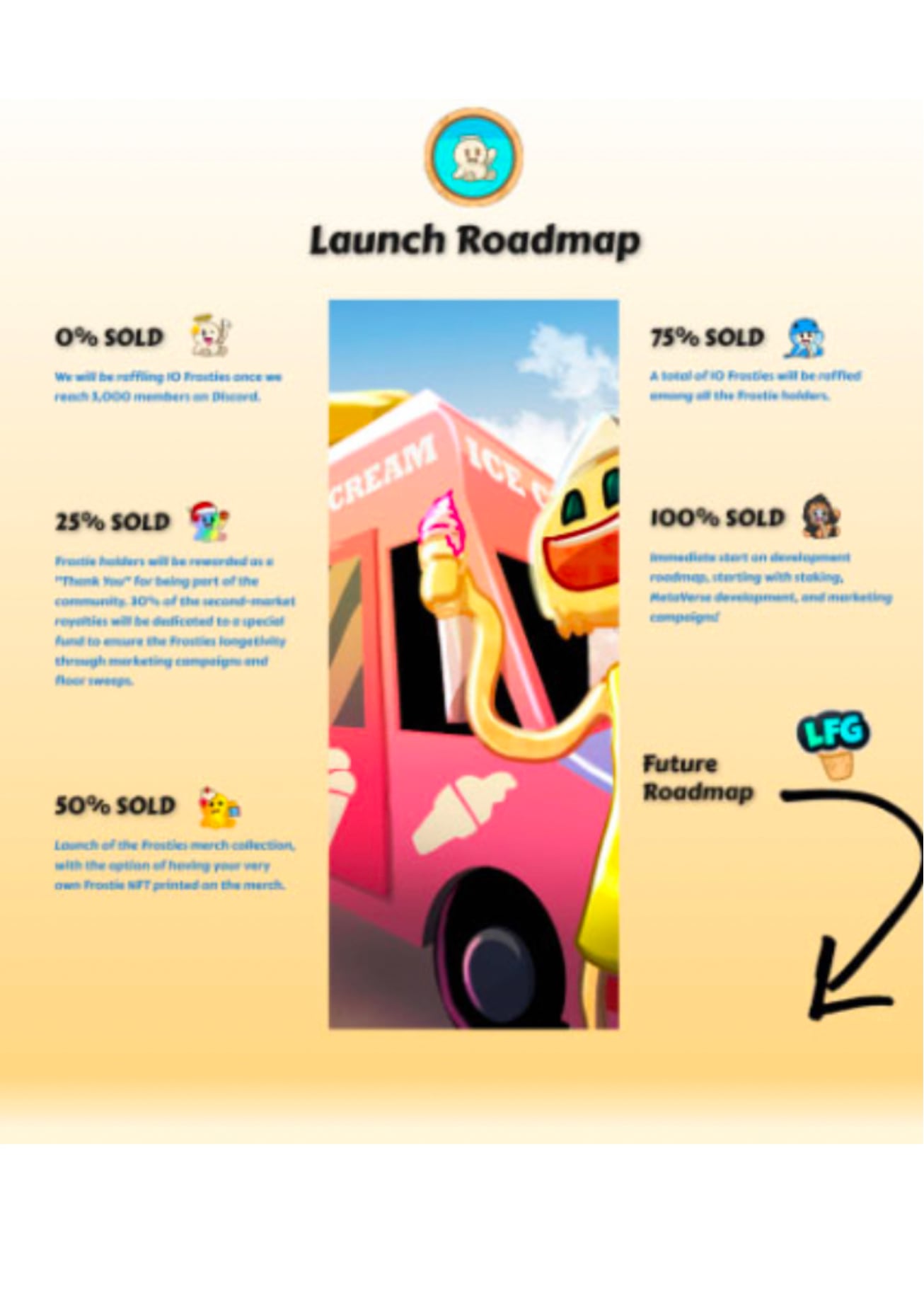

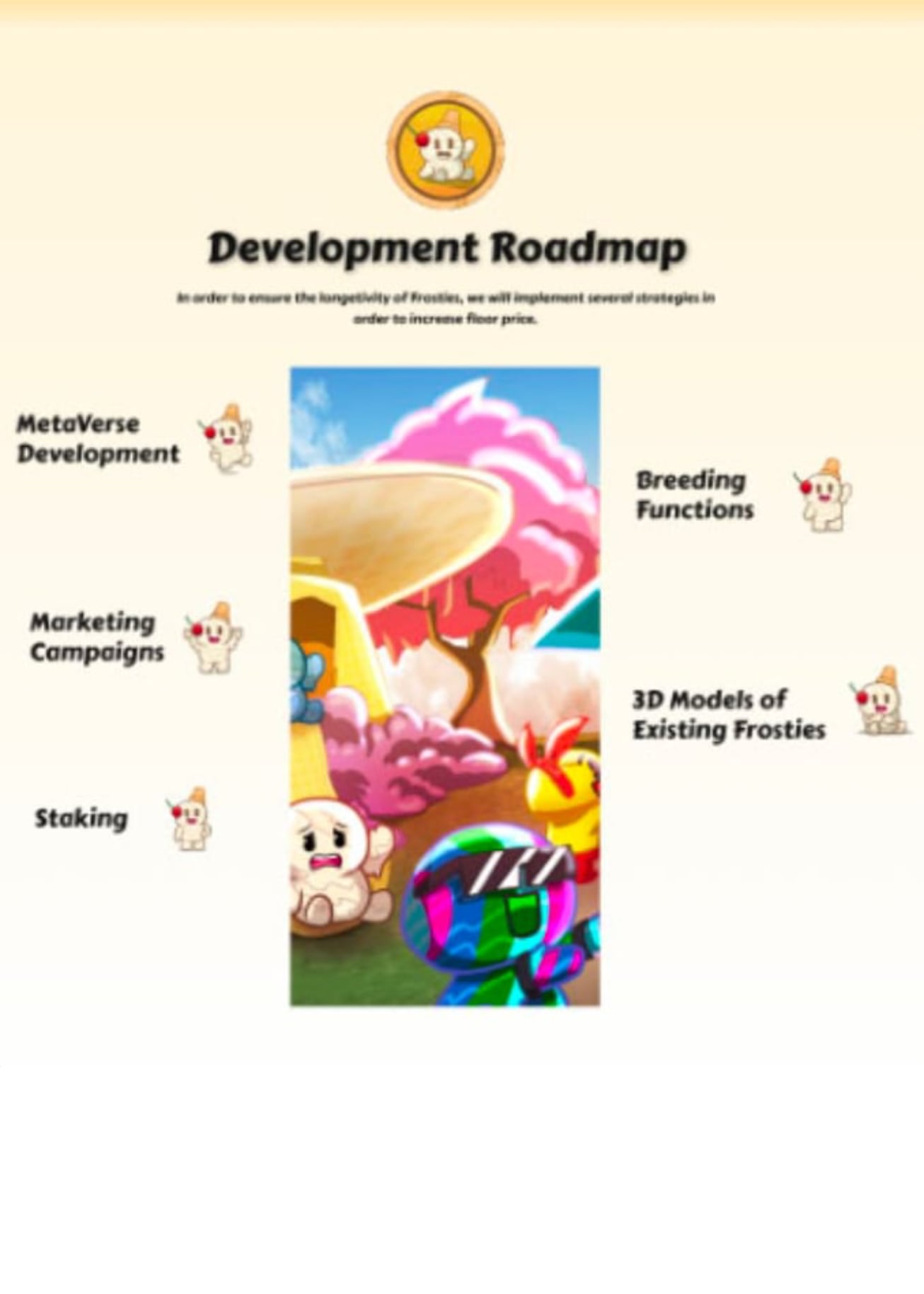

Earlier this year an NFT project called Frosties was outed as a scam after its developers made off with over $1 million in ETH just hours after the project was launched. Ethan Nguyen and Andre Llacuna (both age 20) were both charged with conspiracy to commit wire fraud and conspiracy to commit money laundering after a criminal complaint was filed against them.

According to the U.S. Department of Justice, the duo sold the NFTs to investors but did not give them the “benefits advertised” after the transaction was complete. Instead, the funds from the sales went into different cryptocurrency wallets that the two operated.

There are two basic types of rug pulls, hard and soft.

These occur when a project’s founder uses coding to maliciously use the project as a way to defraud investors. These are illegal and can result in criminal and civil prosecution. A hard rug pull may occur when a smart contract contains hidden terms in its code that are designed to dupe investors with the intent to steal funds.

For example, the Frosties Smart Contract computer code contained a conditional withdrawal function, which when executed by the smart contract owner, initiated the withdrawal and transfer of all funds in Frosties Wallet Address to the wallet address of the owner of the Frosties Smart Contract, which was recorded on blockchain as Fraud Wallet Address-1.

In total, approximately 356.56 ETH, then valued at approximately $1.1 million, was transferred from Frosties Address-1 to Fraud Wallet Address-1.

In the Frostie's case, the code serves as prima facie evidence of that intent to mislead and steal investor funds, most commonly locking investors into an asset that has no genuine direction or purpose.

Soft rug pulls aren’t “illegal” per se, but that doesn't mean that they are ethical. They differ from a hard rug pull in the fact that the smart contract code is not designed to defraud investors. But the code doesn’t remove a possible intent to steal or defraud investors either.

In most cases, this occurs when founders and their teams dump their assets rapidly, ultimately devaluing the token and exploiting the profit created from investors buying the cryptocurrency itself. An example of this might be where a crypto project that promises to donate funds, but chooses instead (whatever the reason) to keep the funds.

How to Tell if a Project is an NFT Scam

Scammers in the NFT space are clever. They're becoming more clever all the time. Many victims are not experienced or don’t understand nuances of technology, including blockchain technologies and smart contracts. Crypto scams require an advanced understanding of NFT’s, blockchain technologies, and often some polished marketing skills. Because of that likely disparity, investors should approach any NFT project with a healthy dose of caution.

Here are five metrics to research to help you identify NFT fraud.

Investigate who is behind the project? Are the project’s promoters well-established and active in the NFT community? Are the founders’ accounts recently created, or do they have a longer presence? Answering these questions may tell you something about a project.

Often legitimate NFT projects come down to the artists and developers. Is there a community? Do they engage with it? Have they been around and creating awhile? Are they brand new? What are their goals? What are their motivations?

Admittedly, this isn’t always possible. The creators of Bored Ape Yacht Club intentionally remained anonymous, and other project adopted that business model. It nevertheless is a good place to begin.

BAYC notwithstanding, if you can’t find reliable and verifiable information about the team then you have your first red flag. A project with anonymous developers isn’t necessarily a scam. But preferably, NFT developers should be discoverable. You should be able to find at least a little bit of information about the project leads. This information could become invaluable if the project does turn out to be a scam.

Ask yourself, what remedy do I have against an anonymous individual or company? What jurisdiction, country, state, and county do they work or reside in? Do they have offices? Where are they? If this NFT project is a scam, do I realistically have legal recourse? What are the limits of my remedies? Could I find and serve the project leaders with a court summons if it came down to it?

The federal Complaint against the Frostie’s promoters, Ethan Nguyen and Andre Llacuna, makes for interesting reading – if only because of the founder's anonymity. The federal government employed subpoena and investigative resources available to it that you probably won’t have. Without those resources it is unlikely that Nguyen and Llacuna would have been identified and charged.

A great place to start your research is Twitter. Research the each of the NFT project’s creators and team, individually. They should have social media presences and activity. Their accounts on social media should not have just been created in the last week or two. Ideally, the project team and founders should both follow and have followers on social media, and in the NFT world. Do they tweet regularly? Do they have a record of engaging with others on social media and otherwise? If you see a recently created twitter account, with few tweets, and no other social media presence, that’s a red flag.

If an established artist announces a new project, it’s usually pretty easy to confirm whether or not it’s legitimate. But when a project starts gaining a following, and you can’t even discover if the “Lead Artist” or “Marketing Director” is even a real human being, that’s a red flag. Again, the Frost’s NFT project is telling. The Frosties Website listed “Frostie” as the “founder, developer, and artist,” “Andre” as the “Community Manager,” and the entire “Frosties Team” as the following: